Highlights |UPSC Exam Current Affairs 19-12-2019

Current Affairs and News (19-12-2019)- The following article contains all the updated events and news for IAS Preparation. Our daily IAS Current Affairs and News cover the most important topics to give precise information to the reader and IAS Aspirants.

- National Company Law Appellate Tribunal (NCLAT): ReinstatesCyrus Mistry as Tata Sons Chairman

- GST Council: Votes for first time to tax all lotteries at 28%

- Mahadayi Project: Goa gets relief

- Sahitya Academy: Shashi Tharoor wins Akademi’s 2019 award for English

- Joint River Commission: Bangladesh gives a miss

- Indian economy is losing its growth momentum (Part 2)

- Right to information: ‘Abuse’ of RTI

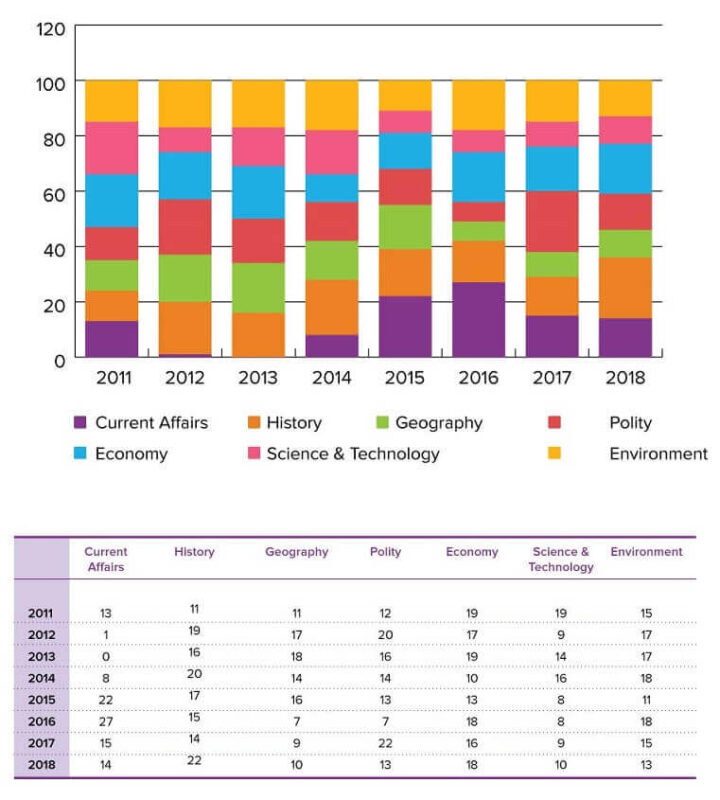

Importance of Current Affairs in IAS Coaching

Watch Video – UPSC Exam Current Affairs 19-12-2019

Video Source – Shankar IAS Academy

find top institutes for IAS coaching

UPSC Exam Current Affairs 19-12-2019 are followed in the part below:

UPSC Exam Current Affairs and News Analysis (19-12-2019)

National Company Law Appellate Tribunal (NCLAT): ReinstatesCyrus Mistry as Tata Sons Chairman

Part of: GS Prelims and GS Mains II – Polity; GS –III – Corporate Governance

In News

- NCLAT alongside reestablishing Cyrus Mistry (who was expelled by the Board of Tata Sons) as Chairman of Tata Sons, likewise requested to Tata Sons to return from ‘privately owned business’ to ‘open organization’

Value Addition: About NCLAT

- NCLAT was comprised under Section 410 of the Companies Act, 2013.

- NCLAT is the Appellate Tribunal for hearing interests against the requests cruised by –

- National Company Law Tribunal(s) NCLT(s) under Section 61 of the Insolvency and Bankruptcy Code, 2016 (IBC)

- Indebtedness and Bankruptcy Board of India (IBBI) under Section 202 and Section 211 of IBC.

- Rivalry Commission of India (CCI) – according to the correction brought to Section 410 of the Companies Act, 2013

GST Council: Votes for first time to tax all lotteries at 28%

Part of: GS Prelims and GS Mains III – Economy; GS-II- Federalism

In News

- GST Council broke its convention of taking choice by agreement and for first time decided in favor of a proposition to assess all lotteries at a uniform rate at 28% (21-7 in support)

Do You Know?

- In the initial eight months of this budgetary year, just about half of GST assortment targets (₹6,63,343 crore) and 60% of pay cess assortment targets have been accomplished.

- The GST Council is a sacred body set up under Article 279A of Indian Constitution

- The GST Council is led by the Union Finance Minister.

- Its different individuals are the Union State Minister of Revenue or Finance and Ministers accountable for Finance or Taxation of the considerable number of States.

- Casting a ballot Rights

- Focus: 33% of complete votes cast

- States: 66% of the complete votes cast (Each state, large or little, will have equivalent vote)

- For any proposition to be cleared by the chamber, it needs to get 75 percent of the vote.

Mahadayi Project: Goa gets relief

Part of: GS Prelims and GS Mains II- Federalism

In News

- Association Environment Ministry kept in suspension its letter gave to Karnataka which had expressed no natural leeway was required for Kalasa Banduri Project.

About Kalasa Banduri project

- The undertaking includes redirecting water from Mahadayi waterway, the help of Goa, into the Malaprabha stream.

- The Kalasa Banduri venture is planned for giving drinking water to three significant locale of north Karnataka — Belagavi, Gadag and Dharwad — which go dried in summer because of intense water shortage.

- Mahadayi waterway begins from a bunch of 30 springs at Bhimgad in the Western Ghats in the Belgaum area of Karnataka. At that point it enters Goa lastly depletes in Arabian ocean.

- Goa state capital Panaji lies on the banks of Mandovi

- Mahadayi Water Tribunal (MWT) Award in 2018:Karnataka has been apportioned 13.5tmcft of water, Goa has been 24tmcft while Maharashtra has been designated 1.3tmcft.

Sahitya Academy: Shashi Tharoor wins Akademi’s 2019 award for English

Part of: GS Prelims and GS-I – Culture

In News

- Sahitya Akademi grant set up in 1954, is an abstract respect that is presented every year by Sahitya Akademi, India’s National Academy of letters.

- Grant is displayed to the most remarkable books of abstract legitimacy distributed in any of the twenty-four significant Indian dialects perceived by the Akademi (counting English).

- Sahitya Akademi grant is the second most elevated scholarly respect by the Government of India, after Jananpith grant.

- The Award as an engraved copper-plaque, and money prize of Rs. 1,00,000/ –

- The creator must be of Indian Nationality.Indian movie producer Satyajit Ray is the fashioner of the plaque granted by the Sahitya Akademi.

Joint River Commission: Bangladesh gives a miss

Part of: GS Prelims and GS-II- International Affairs

In News

- Bangladesh has not sent a designation for the Joint River Commission (JRC) meeting with India which throws question over advancement of Feni waterway water sharing understanding

- Bangladesh had consented to let India pull back 1.82 cusecs from the Feni waterway to supply the bordertown of Sabroom in the northeastern State of Tripurafor drinking water purposes

- Feni River is a trans-limit waterway that begins in Tripura and courses through Sabroom town and afterward enters Bangladesh.

(MAINS FOCUS)

ECONOMY

TOPIC: General Studies 3:

- Indian Economy and issues identifying with arranging, preparation of assets, development, improvement and business.

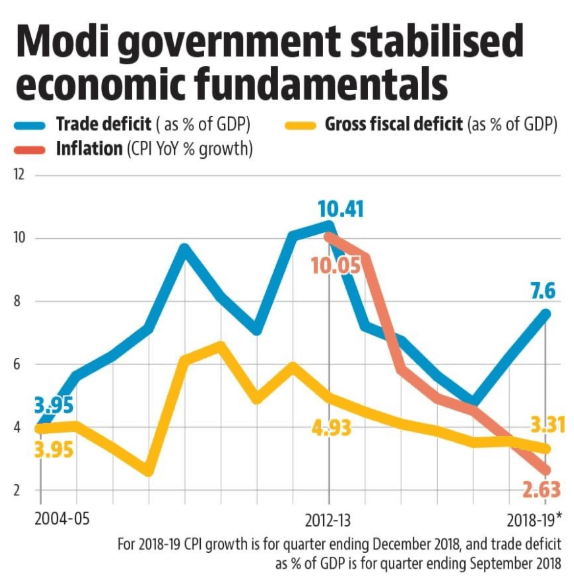

Indian economy is losing its growth momentum (Part 2)

Before reading this read part 1 : Link

| Gross domestic product = C + G + I + (NX)In different words, four drivers decide a nation’s GDP.These are:C – the all out consumption (request) by private people G – the absolute use (request) by the Government I – the complete use (request) on speculations made organizations in the nation NX – the net impact of imports and fares |

Derailed Indian economy in 2016 and 2017

| Two reasons and 4 Balance sheets problem1. The uncertain TBS problem2. The fall of NBFCs and the land sectorTogether, they make for the Four Balance Sheet Challenge for the Indian economy |

Purpose behind the disappointment of NBFCs : breakdown of ILFS in 2018, with Rs 90,000 crores of obligation

Reason 1 : NBFCs depended on raising transient assets ,This prompts a circumstance called a benefit obligation bungle. For instance, a NBFC fund-raises by selling half year obligation papers and on-loans this as a vehicle advance with a residency of 5 years. This prompts a circumstance where the NBFC needs to turn over (or restore) the half year obligation paper or raise crisp advances to reimburse the obligation paper. In great occasions, this occurs as is normally done. Be that as it may, when difficulties are out of hand, this cycle is broken.

Reason 2 : The cycle was broken by a default of certain organizations of the IL&FS gathering. There were fears this would end up being a disease. Basically, banks, shared assets and their speculators were worried about the possibility that that all the more such elements wouldn’t default. As this dread grabbed hold, numerous organizations wouldn’t offer cash to NBFCs. The expense of assets rose by as much as 150 premise focuses for NBFCs.

Impacts of the NBFCs Failure on Indian economy :

- NBFCs are having an undeniably significant influence in the economy. A lot of credit has expanded on the grounds that they were loaning in areas where banks wouldn’t go or would not like to go.

- Presently that NBFCs are thinking that its hard to fund-raise or paying an enormous expense for doing as such, this will stifle the progression of credit to the economy.

- It will hit the MSME part which is now experiencing the twin blows of demonetisation and the merchandise and enterprises charge.

- It will hit utilization request in the economy( utilization was the essential motor driving the economy).

- A decrease in credit further adds to financial log jam pressures, which are as of now obvious.

- Log jam in credit could prompt another heap of non-performing resources in areas, for example, business land and foundation, which could have economy-wide knockdown impacts

Real estate story:

- Developers propelled various tasks since the beginning of mid-2000s with the expectation that these pads would be sold

- Yet, after the Global Financial Crisis, the interest for pads just as bank subsidizing for developers crumbled.

- The NBFCs led the pack in loaning to the land part.

- By June-end 2019, the land division arrived at a limit with near 10 lakh unsold units (as against a yearly interest of only 2 lakh units) in simply the best 8 urban communities in the nation.

- Land segment was not able compensation back to the NBFCs , which, thusly, began defaulting.

Conclusion:

- India’s GDP has been influenced by various elements at various occasions.

- After Global Financial Crisis, private utilization rescued India. Be that as it may, this segment – “C” – has gotten continuously more vulnerable since 2017 and is today the principle stress.

- G or government spending rescued the GDP yet at the expense of concealing the genuine monetary shortage.

- The “I” or business venture segment has been powerless since the GFC

- sharp repo rate cuts and corporate tax reductions seem inadequate for the time being.

- The net fares or “NX” part has stayed feeble all through since the GFC

Connecting the dots:

- Do you think Demonetisation and GST added to Indian Economic trouble?

- How would you figure Indian economy can be recouped from the misery?

POLITY

TOPIC: General Studies 2:

- Significant parts of administration, straightforwardness and responsibility, e administration applications, models, triumphs, confinements, and potential; residents sanctions, straightforwardness and responsibility and institutional and different measures.

Right to information: ‘Abuse’ of RTI

Context:

- Boss Justice of India said the unbridled utilization of the Right to Information (RTI) Act had made a feeling of “loss of motion and dread” in the legislature.

- Loss of motion and dread about this Act (RTI). Individuals are not taking choices

- CJI said opportunity had arrived to set down rules on the utilization of the RTI. Rules ought to be set up to check the locus of the RTI candidate and put a “channel” on the sort of solicitations made under the 2005 Act.

| Equity Bobde stated :The court was not against the activity of the privilege to data. “In any case, it can’t be an unmatched right. There is the major issue of individuals documenting RTI demands with malafide aims, individuals set up by rivals,” he said. The RTI Act had become a wellspring of criminal terrorizing by individuals with an issue. “Criminal terrorizing is a pleasant word for ‘extortion’,” Justice Bobde said. |

Genesis of RTI:

- 1975, in State of Uttar Pradesh versus Raj Narain “The individuals of this nation reserve a privilege to know each open demonstration, everything that is done in an open path by their open functionaries. They are qualified for know the specifics of each open exchange in the entirety of its bearing. Their entitlement to know, which is gotten from the idea of the right to speak freely of discourse, however not total, is a factor which should make one watchful when mystery is guaranteed for exchanges which can at any rate have no repercussion on open security.”

- It watched, “Voters’ (little man-residents’) right to realize forerunners including criminal past of his up-and-comer challenging political race for MP or MLA is significantly more principal and essential for endurance of majority rule government.

RTI Act

- A candidate making demand for data will not be required to give any explanation behind mentioning the data or some other individual subtleties with the exception of those that might be important for reaching him.

- “The data which can’t be denied to the Parliament or a State Legislature will not be denied to any individual “Bhagat Singh versus CIC in 2007, at that point Delhi High Court Justice Ravindra Bhat (presently a Supreme Court judge) watched: “Access to data, under Section 3 of the Act, is the standard and exclusions under Section 8, the special case.

- Segment 8 being a limitation on this key right, should consequently be carefully interpreted. It ought not be translated in way as to shadow the correct itself.”

SC Judgements:

| Jayantilal N Mistry versus Reserve Bank of IndiaPublic Information Officers under the pretense of one of the special cases given under Section 8 of RTI Act, have dodged the overall population from getting their hands on the legitimate data that they are qualified for. The perfect of ‘Government by the individuals’ makes it important that individuals approach data on issues of open concern. |

| DAV College Trust and Managin versus Director of Public InstructionsDeclared that NGOs are not past the RTI Act.This depended on an assessment of the inquiry whether NGOs are generously financed by the government.Because of this perception, the spotlight falls of a few NGOs that have been getting open cash and were not secured under the RTI. |

| Focal Board of Secondary Education (CBSE) and Anr versus Aditya Bandhopadhyay and Others in 2011Nearly 60-70 lakh RTI applications are documented in India consistently, and activists have addressed in the case of tending to these would require 75% of the hour of government staff. A few open specialists have utilized this perception while denying data, disregarding the reality in a similar case, the Supreme Court had requested divulgence of the essential information.SC : “The country doesn’t need a situation where 75% of the staff of open specialists invests 75% of their energy in gathering and outfitting data to candidates as opposed to releasing their customary obligations” |

| Girish Ramchandra Deshpande versus Central Information Commission and Ors in October 2012The execution of a worker/official in an association is essentially an issue between the representative and the business and ordinarily those angles are administered by the administration rules which fall under the articulation ‘individual data’ the exposure of which has no relationship to any open movement or open interest.if the Central Public Information Officer or the State Public Information Officer of the Appellate Authority is fulfilled that the bigger open intrigue legitimizes the divulgence of such data, proper requests could be passed yet the candidate can’t guarantee those subtleties as an issue of right |

Conclusion:

- A Transparency Audit report submitted to the Central Information Commission (CIC) in November 2018 looked for input from 2,092 PAs under the CIC to assess execution of Section 4 of the Act. Just 838 (40%) reacted and even here, 35% of the PAs fared inadequately with little straightforwardness in parameters, for example, association and capacities, spending plan and program, e-administration, and other data revelations.

- The other key hesitation with RTI execution has been the enduring issue of opportunities in the CIC and State commissions — the CIC has four opening and 33,000 pending cases. After the top court’s headings, this lacuna ought to be tended to by governments rapidly.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Q.1) National Company Law Appellate Tribunal (NCLAT) can hear appeals against the orders passed by which of the following bodies?

- National Company Law Tribunals

- Competition Commission of India

- Insolvency and Bankruptcy Board of India

Select the correct answer from codes given below.

- 1 only

- 1 and 2 only

- 1 and 3 only

- 1,2 and 3

Q.2) Consider the following statements about GST Council

- GST Council is a constitutional body established under Article 279A of Indian Constitution headed by Union Finance Minister

- Centre has 25% voting power while all the States combined have 75% voting power and for any proposal to be cleared it has to get 66% per cent of the vote.

Which of the statement(s) given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3) Consider the following statements about Mahadayi River

- Goa state capital Panaji lies on the banks of this river

- The Kalasa Banduri project is planned across this river so as to provide drinking water to Northern Karnataka region

Which of the statement(s) given above is/are correct?

- Only 1

- Only 2

- Both 1 and 2

- Neither 1 nor 2

Q.4) Feni is a transboundary river between which two countries?

- India and Nepal

- India and Bhutan

- India and Pakistan

- India and Bangladesh

Importance of Current Affairs in IAS Coaching

Check out more IAS Coaching Current Affairs

Also, Check Out the All the Details about the IAS Exam